New U.S. Record-Level Oil Production! Peak Oil Theory Disproven! Not.

March 6, 2018

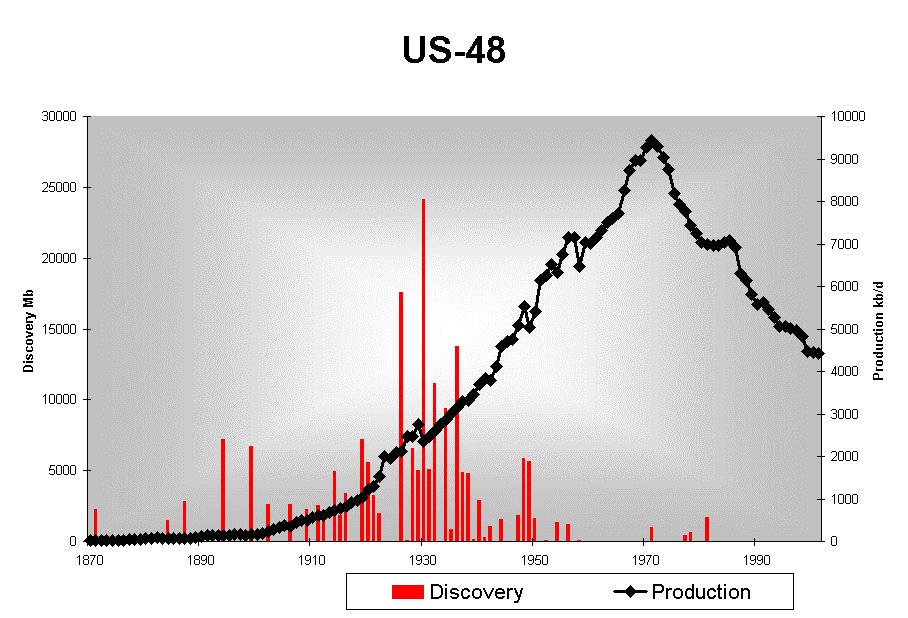

Well, I’m amazed and impressed. Tight oil production has pushed total United States petroleum output to more than 10 million barrels a day, a rate last seen almost a half-century ago. It’s a new U.S. record. Fifteen years ago I was traveling the world with a Powerpoint presentation featuring a graph of U.S. oil production history. That graph showed a clear peak in 1970 and a long bumpy decline thereafter.

My message: as went the U.S., so would go the world at some point in the fairly near future. Peak oil—the inevitable moment when global oil supplies started drying up—would be a watershed for industrial societies, leading to economic contraction, geopolitical crisis, and social upheaval.

So is it time for a retraction? The optics are certainly unfavorable for peak oil theorists like me. Our forecasts obviously failed, in that none of us expected the current surge in U.S. output. But permit me to offer some context.

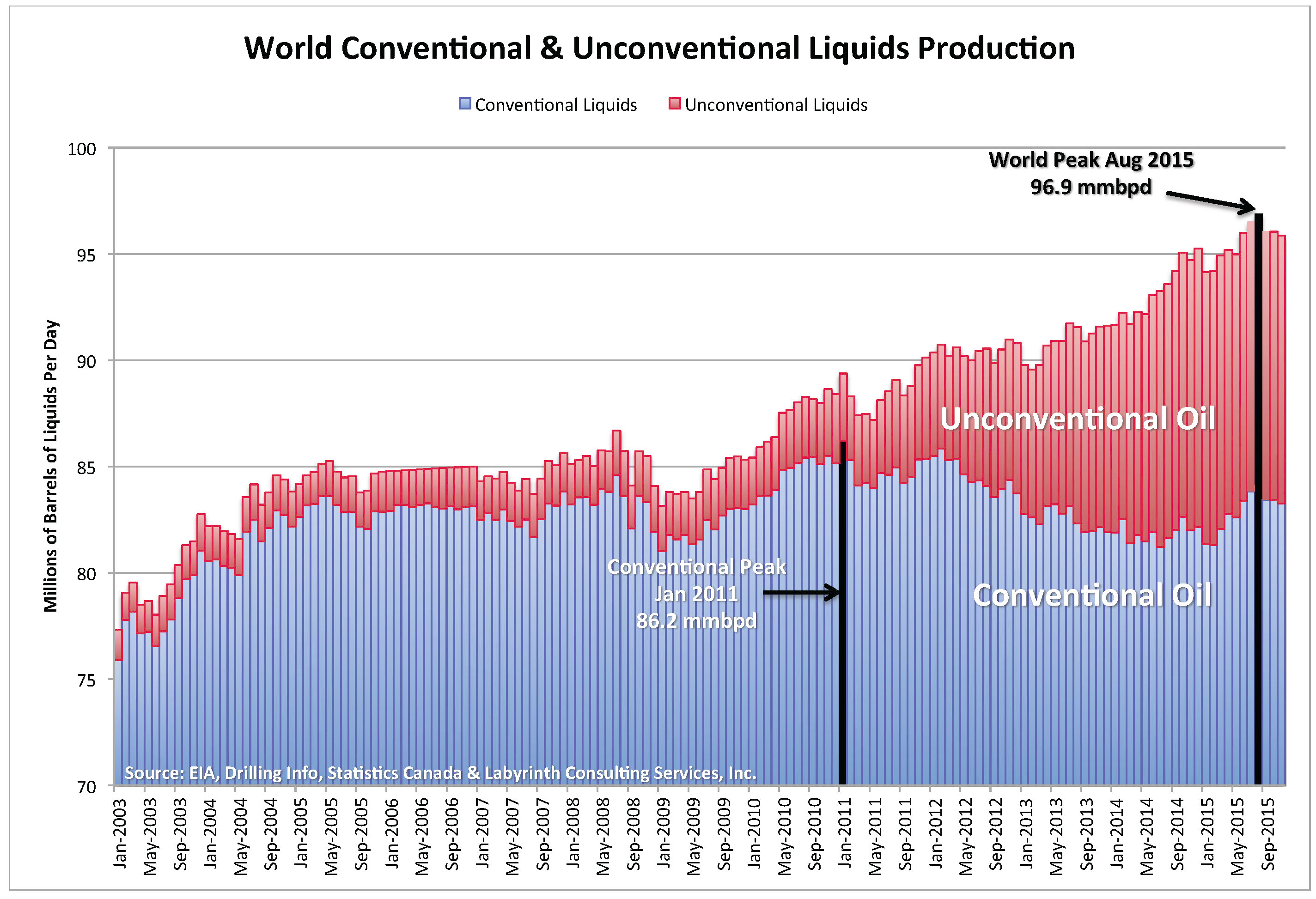

Everyone agrees that the surge is almost entirely due to tight oil (globally, there has also been growth in bitumen from Canada, deepwater oil, and other unconventional sources). The application of hydrofracturing and horizontal drilling to low-permeability source rocks in the United States represents an amazing success story for the oil industry—at least in terms of raw petroleum output. But what conditions led to this bonanza?

Return with me now to those thrilling days of yesteryear—the year 2005, to be precise. That’s when the rate of world conventional oil production stopped growing and hit a plateau that continues to this day. Oil prices were already scrambling upward; by mid-2008 they had zoomed to nearly $150 per barrel. And it was at that moment that the global financial crisis erupted. Which was, by most accounts, a survival threat to industrial society.

The world’s central banks knew they had to act boldly to prevent utter collapse. Their solution (unsurprisingly) was to bail out the investor class, which had steered the world into the crisis to begin with. Over the course of the next few years the Federal Reserve, the European Central Bank, the People’s Bank of China, and the Bank of England together conjured nearly 10 trillion dollars in new money and unleashed it in the accounts of investors.

It was at just this moment that the frackers appeared on the scene. They had the technology and they had the rocks. But they needed a lot of money to fund their ambitious business plans. That’s because the rocks were stubborn. Since those rocks lacked permeability, individual oil wells would deplete very quickly—with production in each well declining on the order of 70 to 90 percent in the first three years. That meant that relentless, expensive drilling would be needed in order to release the oil that was there. But, the frackers promised, with high enough oil prices the venture would be profitable.

Part of the central banks’ strategy to avert economic Armageddon was to keep interest rates low. That made it easy for the oil industry to borrow money. But it also meant that bonds and T-bills began offering pitiful returns. Investors flush with cash needed somewhere else to stash it; they were looking for the next big thing.

Suckers, meet swindlers. Get to know each other, see what you can do together, and report back in a few years.

What happened next? A hell of a lot of drilling. Tens of thousands of holes were poked into the ground and blasted with tons of explosives, billions of gallons of water, and millions of tons of sand. And all were drilled and fracked with somebody else’s money (very likely some of yours, if your savings are locked up in a pension fund). On the whole, the enterprise was hugely unprofitable, and was built on a giant bubble of debt.

Oh, but it gets worse. Like all debt bubbles, the fracking bubble is going to burst at some point. No one knows whether that will happen later this year, next year, or five years from now. But burst it will. And when it does, the carnage will extend far beyond the industry itself.

The frackers insist that their technology is getting better—and it is, in the sense that longer lateral segments, more fracking stages, closer well spacing, and (especially!) drilling preferentially in the most resource-rich areas has increased individual well productivity and lowered costs of production. But that just means that core areas are getting drained even faster; meanwhile, closely spaced wells are starting to interfere with one another, resulting in declining well productivity. Evidence suggests that technological improvement has reached the point of diminishing returns.

Yes, the amount of U.S. tight oil being extracted could continue to grow for a while longer—as long as investors keep ponying up money, or as long as the “sweet spots” last, or if oil prices rise significantly. But then production will fall and the country will gradually (or perhaps quickly) return to dependence on declining conventional oil production.

As all this has been happening, the idea of a near-term peak in world oil supplies has become discredited. So discredited that even when multiple news organizations reported that the rate of new oil discoveries has plummeted to a level not seen since the 1940s, no one dared even mumble the words “peak oil.”

The only permissible way to speak of the subject today is frame it differently—as “peak oil demand.” The logic goes something like this:

- The tight oil boom means that we are moving into a permanent age of oil abundance.

- But the proliferation of electric cars means that demand for oil will reach a maximum and start to decline.

- With supply beginning to exceed demand, there’s not enough investment going into future oil exploration and development.

- Without enough investment, production will decline.

- But production can’t decline due to supply problems, because we are moving into a permanent age of oil abundance. Therefore if and when oil production does decline, it will be because of other factors.

Sometime in the next few years, global oil output will indeed start to fall and the fact will be undeniable—even though the cause will likely be attributed to a financial or economic crash. But even if tenacious peak oil supply theorists feel vindicated, confirmation of their warnings will carry no sweetness. That’s because the whole point of the peak oil discussion was to warn society ahead of time so that it could prepare itself for the inevitable moment when the economic impacts of oil depletion hit home. The Hirsch Report in 2005 concluded that it would take a modern industrial nation like the United States at least a full decade to prepare for peak oil.

We had our ten years of warning and we blew it. Sure, we deployed a few electric cars, issued some subsidies for solar and wind power, and fledged voluntary efforts to build community resilience, but we haven’t done anything commensurate with the scale of the problem. And now the current U.S. administration has decided to throw the energy transition into reverse, discouraging alternative energy and expanding subsidies for fossil fuels. Unless the fracking boom can persist for another decade (which seems highly unlikely, given the economics and other factors) and the shift to electric vehicles accelerates ferociously, we will have run out the clock. When the crisis hits, it will be too late for the nation to do much of anything. It will be up to communities to respond as intelligently as they can. All there’s time for now, in all likelihood, is bracing for impact—which translates to building community resilience.

Meanwhile, let’s celebrate. Pop the cork. A new U.S. oil production record! It’s good to have something to cheer about.

Featured image via Pixabay.