Alaska’s Coal: Flashpoint for Coming Climate Battles

July 3, 2013

If there is any place on planet Earth where we should dig in our heels against expanded coal mining, it is surely Alaska. Imagine the environmental travesty of ships by the hundreds laden with coal dug from pristine Arctic tundra, bound for power plants in smog-choked Chinese cities. It’s not happening yet, but there are plenty of people working to make it so.

Here’s the back-story.

Coal is the most carbon-intensive of the fossil fuels, and our planet has enormous amounts of it. However, as I explained in my 2009 book Blackout, the vast majority of the world’s coal will never be mined for purely practical reasons: it’s too deeply buried, it’s in inconvenient places (under seas or cities), the seams are too thin, or the quality of the resource is too poor to justify the effort.

The world’s nations have been digging up coal for over two centuries now, and have naturally picked the low-hanging fruit first. Most of Europe’s minable coal is gone; meanwhile the United States has largely depleted its best anthracite and eastern bituminous reserves and is relying on ever-lower-grade western bituminous and sub-bituminous coals.

China is currently burning half the world’s mined coal, depleting domestic reserves so quickly that a peak and decline in extraction rates is likely before the end of this decade. China and India are both heavily reliant on coal as their main energy source, and both are set to begin importing increasing amounts. The entire sea-borne international coal trade currently amounts to roughly a billion tons; in comparison, China burns 4.1 billion tons, almost all of it from domestic mines. By one estimate, China’s coal demand is likely to reach 7 billion tons per year by 2030. As both China’s economy and its appetite for coal grow, there is potential for the international coal trade to double, triple, or even quadruple.

Predictably, nations capable of exporting coal are eyeing China and India as huge new markets. Indonesia is China’s biggest existing supplier, while Australia is the world’s largest exporter overall.

Could American mining companies cash in on Asia’s coal addiction? That would seem to make little sense if, indeed, US reserves are depleting rapidly. But the coal industry’s priorities do not include line items like “ensuring a sound long-term national energy policy” or “preventing climate catastrophe.” Instead, decisions are made on the basis of simple corporate profit seeking. Low natural gas prices (caused by a temporary glut of shale gas production) have led power utilities across the United States to substitute gas for coal, thereby reducing coal demand. In addition, President Obama has just tasked the EPA with developing carbon regulations for US power plants—and the result will almost certainly be a decline in coal consumption. Suddenly US coal companies are capable of mining much more than they can sell domestically.

The obvious solution to this surplus of coal (from a business point of view) is to export it. Keeping the stuff in the ground might make more sense if the fate of future generations were top priority, but doing so wouldn’t help the balance sheets of companies that own mineral rights and mining equipment. And so plans are being drawn for coal export terminals in Oregon and Washington, so that Wyoming coal can find its way to Shanghai, Seoul, or Bangalore.

Everyone who’s in the know about America’s energy prospects realizes that this is a short-term gambit aimed merely to raise domestic coal prices over the next few years. As a US Geological Survey study has shown, Wyoming’s coal production rates cannot be maintained at current levels much longer. Coal export terminals in Cherry Point and Longview in Washington, and Boardman in Oregon, if they’re built, will have only a brief period of usefulness—as will the LNG terminals being planned to export America’s shale gas.

This is where Alaska comes in.

We’ve depleted most of the planet; what’s left?

Of all countries, the United States has the most coal, and the majority of America’s coal resources are in Alaska.

In order to understand the significance of that statement it is essential first to grasp the difference between resources and reserves: the former refers to the total amount of coal present (as estimated using standard techniques of measurement and inference), while the latter describes the portion of the resource base that could profitably be extracted with current technology. Reserves are always a fraction of resources. While Alaska’s coal resources are immense, reserves have been assessed to be very small due to the fact that little coal is currently being mined there, and the logistical problems in expanding mining to new areas would be daunting.

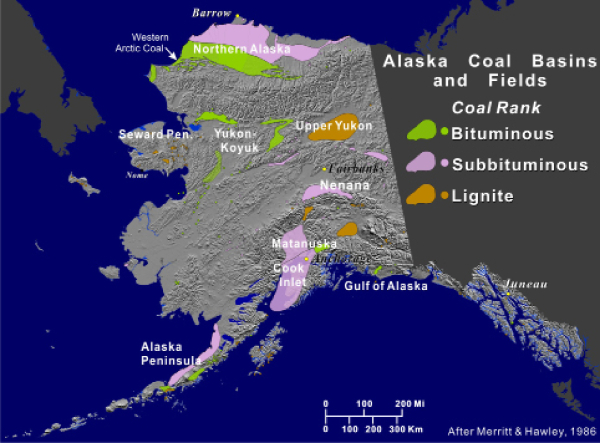

The Arctic or North Slope region of the state boasts the most coal resources (the North Slope was the site of Alaska’s oil boom back in the 1980s, and, though oil production there has waned substantially, oil revenues still fund the state’s economy). BHP Billiton has coal exploration leases in the North Slope covering 1.75 million acres, though active exploration ceased a few years ago. Three other companies (Beischer and Associates, Xplore LLC, and St. George Ventures) are seeking access to 116,000 acres of coal deposits on state land in the Arctic.

Anchorage, Alaska’s largest city, is situated at the end of Cook Inlet; geologists estimate that up to 1.5 trillion tons of coal may be located under the waters of the Inlet. Additional coal is to be found on the west side of the Inlet, and still more on the Kenai Peninsula. Several mines have been proposed for these latter sites, though none has yet applied for a permit.

Smaller deposits are located in central Alaska and Matanuska-Susitna Valley.

Currently the Usibelli mine, located in the mountains of the Alaska Range roughly 300 miles north of Anchorage, is the state’s only active coalmine; it exports about a million tons a year. The coal moves by rail to the Port of Seward (roughly a hundred miles east of Cook Inlet and south of Anchorage), the majority of it bound for South Korea. But this is a proverbial drop in the bucket in terms of the state’s export potential.

Altogether, Alaska claims some 5.1 trillion tons of coal resources—five times the coal resources of China. In contrast, Alaska’s coal reserves currently amount to less than 3 billion tons, or just nine month’s worth of China’s current total consumption.

Soaring coal prices (driven by Asian demand) could drive that latter figure far, far higher.

It won’t be easy

Further exploration could transform more of Alaska’s coal resources into reserves, and many of the logistical hurdles that have prevented development of mining infrastructure in the past are capable of being overcome, at least in principle. Much of Alaska’s coal can be surface-mined, which is cheaper—though usually more environmentally destructive—than underground mining. Most of it is also located close to the sea, and Cook Inlet is a convenient site for future coal export terminals. Moreover, reduced sea ice (thanks to climate change) could make shipping from the North Slope practical.

Still, remaining obstacles are far from trivial, and substantial investments would be required. The North Slope is rugged, extremely remote territory, and workers can be lured there only by high wages. The abundant coal beneath Cook Inlet is likely to be exploited only by way of underground gasification, a technology that has remained in its experimental stage for decades. Subtract the North Slope and Cook Inlet subsea resources from Alaska’s total, and what remains is a relatively modest potential reserve base.

Potential Asian buyers are so far proving more of a hindrance than a help: most Asian power companies require a demonstrated production capacity of over one million tons per year before issuing a coal export contract, but no one is likely to pony up the investment capital required to start a mining project without an export contract in place. It’s a classic Catch 22.

In sum, it’s entirely possible that logistical and economic barriers will prevent the large-scale expansion of Alaskan coal exports. However, the side of the ledger headed “Why exports might grow anyway” needs only a single entry: “China.” That country has a famous propensity for buying up access to resources across the planet. Half of the oil currently being pumped from war-torn Iraq is Beijing-bound; China also has oil interests in Africa, South America, and Canada.

If China wants Alaska’s coal, what could stand in the way?

Time to say No

Only citizen opposition and government policy are likely to prevent what could otherwise amount to the pointless destruction of millions of acres of wilderness and a dramatic exacerbation of climate change—all for the purpose of short-term, unsustainable economic expansion halfway around the globe. Fortunately most national US environmental organizations have stated their opposition to the extraction and export of Alaska’s coal; the Sierra Club is notable in this regard. Several state and local environmental groups are also engaged in lobbying and protests.

There are many reasons to oppose coal mining in Alaska. Even current rates of mining and exporting coal are environmentally problematic: export facilities in Seward have bathed the surrounding community in coal dust pollution, which has been the focus of lawsuits by Trustees for Alaska, Alaska Community Action on Toxics (ACAT), and the Sierra Club. Aside from its impact on human lungs, coal dust darkens snow and ice. Mining and exports at 20, 50, or 100 times the present scale would spread coal dust far and wide throughout the state, exacerbating the Big Melt that’s already causing the rapid shrinking of Alaska’s glaciers and the disappearance of roads.

Recent years have seen bitter controversy over the prospect of oil drilling in the pristine Alaskan National Wildlife Refuge (ANWR) near the North Slope. Coal mining in adjacent regions would likely be far more destructive than oil and gas exploration. The coal would be surface-mined, entailing massive disruption of landscapes and untold impacts to wildlife.

It’s safe to assume that every increment of expanded mining would lead to a commensurate increase in atmospheric greenhouse gases. In fact, however, exporting coal from Alaska to Asia will have a disproportionately large climate impact due to the combination of additional transportation emissions, less efficient end use, and a lowering of incentives for Asian nations to seek energy alternatives.

The bitter irony for Alaskans would be that the local effects of coal-fueled climate change would be especially severe. Polar regions are warming faster than the rest of the globe, and Alaskans are already dealing with record heat waves, melting tundra, and rapidly changing ecosystems.

Environmental arguments alone often don’t win energy debates. Policy makers and potential investors must be made to understand that exporting coal from Alaska is highly risky from a purely financial perspective. True, coal is the world’s fastest growing energy source—for now. But, as nations begin to put a price on carbon emissions, that is likely to change.

Coal export boosters will likely point to the enormous scale of Alaska’s resources. But given realistic assessments of mining costs, the vast majority of these coal resources are likely to remain just that—resources, not reserves.

Further, export plans assume ever-expanding demand from China. But China’s economy is balanced on a knife-edge. There are good reasons to think that China’s energy demand may not expand in coming years at anything like the pace of the past decade. In that case, investments in Alaskan mining and port infrastructure could be stranded.

Export Alaska’s coal? Somebody’s probably stupid and greedy enough to try. But it’s a very bad idea, and we should say so.

Originally published at Resilience.org